We want you to have a genuine sense of freedom and security to do the things you want to do, knowing we will look after the rest.

Sign up to receive our Wealth & Well-Being Newsletter.

Money is only important to the extent that it allows you to do those things that are important to you.

We start with a meaningful, genuine conversation about what is important to you and creating a shared vision and roadmap to guide us.

Investment Planning is more about focusing on protecting and growing your money through asset allocation rather than an issue of which stock, bond or money manager is best.

We adhere to an investment viewpoint which focuses on:

The four components of Wealth Management are:

Managing your money without understanding the four components of your financial life is not advising, it’s just selling. We advise.

We are commited to providing world class service and being accountable in all we do.

We follow the C.A.R.E. Principle:

Be Candid

Be Authentic

Have the Right People

Execute on what we say

In the end it boils down to people. Our team is one of the best.

Our advice is clear, concise and candid. We are built on knowledge and experience, not marketing hype.

Authentic and knowledgable is what we are.

Honesty and confidentiality are what we provide.

We deliver what we say we are going to do and when we say we will do it.

Business owners, active and retired. We provide holistic planning that integrates the family business with the business of the family.

Executives, who have complex compensation packages. We can collaborate on tax and estate strategies.

Professionals with incorporated businesses. We integrate corporate investment and tax planning with personal tax and estate strategies.

Retirees who want to know their financial and estate affairs are being looked after and that they and their families are going to be ok. We advise in a holistic manner which encompasses family and finances to ensure all the details are looked after so they can live fulfilling lives throughout their retirement

The next generation of client families, whether it be 2nd or 3rd. We help the next generation get established on the right track. It’s not only important to the family; it’s important to us.

CI Assante Wealth Management

We help our clients live a full life by building a comprehensive wealth plan rooted in evidence-based investment research, accompanied by deep caring and commitment on what is important to our clients.

Our advisory group consists of Chad Butnari, Chris Horn, and Mike Andrews. We are supported by a team of multi-disciplined professionals both internally and externally who share our core values that embrace thoroughness, collaboration, and client care.

From a single individual in 1987 to a thriving, multi-faceted team, The Andrews Group has succeeded based on our desire to consistently innovate, be proactive and be a leader in the industry, a champion for our clients and always provide exemplary advice. We want to make a difference in our client’s lives, freeing their time through our comprehensive wealth planning services to allow them to do what they enjoy. We are always looking ahead so our clients can enjoy the present and be better prepared for the future.

Our Three Unique’s

Our Collaborative wealth planning services are built around three foundational pillars.

Our strategies, whether tax, estate or business always have a lens on the impact to family unity.

Business/wealth and family are intertwined and can lead to conversations that jeopardize continuity. We are always aware and work to ensure business and/or wealth continuity is preserved.

Money makes some things easier, some things harder. Money does not buy happiness. It’s important to us with financial success, clients are aware of the six pillars of wellbeing which can help them live fun, fulfilling lives.

We free our clients time to do the things they enjoy, we protect them from potential dangers, we guide them through complexities, and we provide clarity of the present, a road map for the future, and advice that touches every aspect of their life.

Areas of vulnerability can have an adverse effect on your financial security, and insurance can be a component of risk management. Our belief is that insurance with a purpose is a strategy. Without a real purpose, insurance is a product that is sold. We always discover the purpose within the bigger wealth plan.

Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Is your family or business going to be protected in the event of an unforeseen tragedy?

We free our clients time to do the things they enjoy, we protect them from potential dangers, we guide them through complexities, and we provide clarity of the present, a road map for the future, and advice that touches every aspect of their life.

Areas of vulnerability can have an adverse effect on your financial security, and insurance can be a component of risk management. Our belief is that insurance with a purpose is a strategy. Without a real purpose, insurance is a product that is sold. We always discover the purpose within the bigger wealth plan.

Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Is your family or business going to be protected in the event of an unforeseen tragedy?

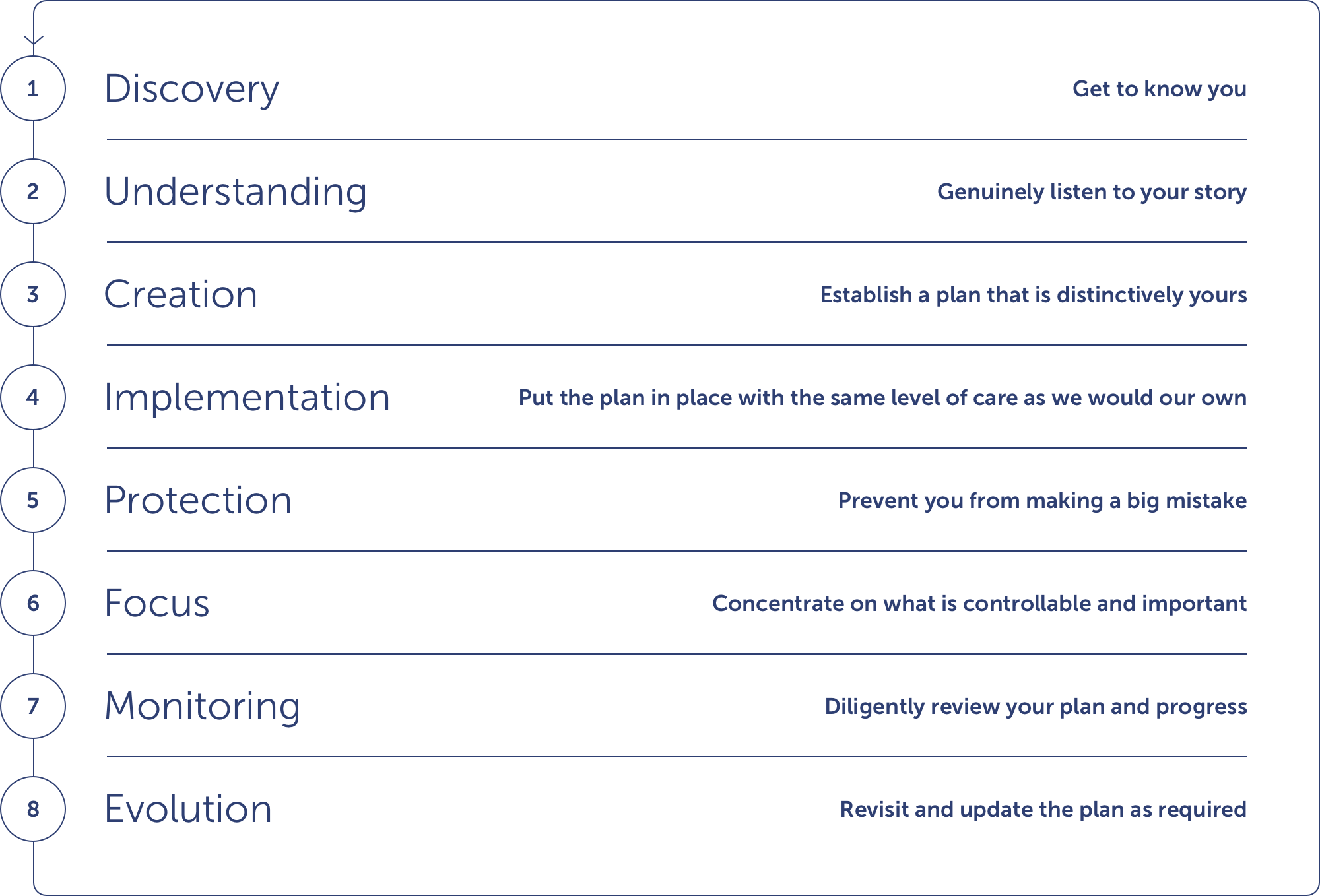

DISCOVERY

Get to know you

UNDERSTANDING

Genuinely listen to your story

CREATION

Establish a plan that is distinctively yours

IMPLEMENTATION

Put the plan in place with the same level of care as we would our own

PROTECTION

Prevent you from making a big mistake

FOCUS

Concentrate on what is controllable and important

MONITORING

Diligently review your plan and progress

EVOLUTION

Revisit and update plan as required